The Corporate Transparency Act (CTA) mandates that businesses in Campbell, CA, disclose Beneficial Ownership Information (BOI) to FinCEN to strengthen efforts against financial crimes like money laundering and tax evasion.

As of today, 11-26-2024, Campbell business owners have 36 calendar days (or 27 business days) to file their BOI reports with FinCEN—failure to comply could result in fines of up to $500 per day.

Steps for Campbell Businesses to Ensure Compliance

1. Confirm Your Reporting Obligation

Deadline: ASAP

Most LLCs, corporations, and other small businesses must file unless exempt, such as banks, charities, or publicly traded companies.

2. Identify Beneficial Owners

Deadline: 12-10-2024

A beneficial owner is someone who:

-

Owns 25% or more of the company, or

-

Exercises significant control over its operations.

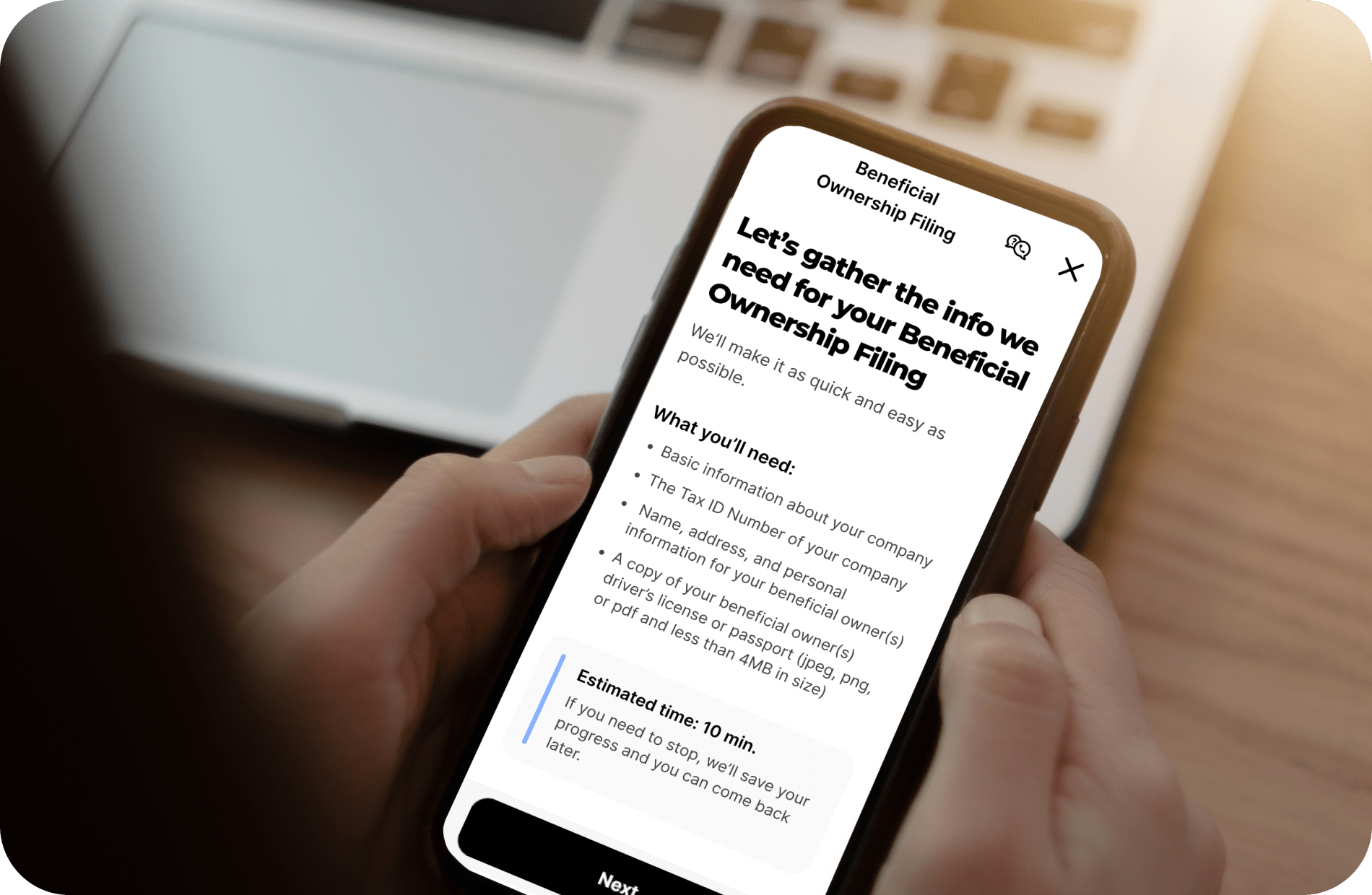

3. Gather Necessary Information

Deadline: 12-17-2024

You will need:

-

Company Details: Legal name, EIN, physical address.

-

Owner Details: Names, birthdates, addresses, and ID numbers.

4. Submit Your BOI Report

Deadlines:

-

Companies formed before 2024: File by 01/01/2025.

-

Companies formed in 2024: File within 90 days of formation.

-

Companies formed in 2025 or later: File within 30 days of formation.

ZenBusiness can help simplify the BOI filing process—get started today.

Key Details About BOI Filing

Who Needs to File?

Most small businesses, including local retailers, consultancies, and startups in Campbell, CA, are required to file. Exemptions include banks, nonprofits, and companies listed on major stock exchanges. For example, a local boutique or tech startup in Campbell would likely need to comply.

What Is a Beneficial Owner?

A beneficial owner is anyone who either:

-

Owns 25% or more of the company, or

-

Exercises significant control over business operations.

For example, if a Campbell coffee shop has two owners, one holding 30% equity and the other handling day-to-day management, both are considered beneficial owners.

What Information Is Required?

Businesses must provide:

-

Company Information: Legal name, EIN, address.

-

Owner Information: Names, addresses, birthdates, and valid ID documentation.

How and When to File

File electronically via FinCEN’s online system. Deadlines are based on the company’s formation date:

-

Existing companies: 01/01/2025.

-

Companies formed in 2024: 90 days post-formation.

-

Companies formed after January 1, 2025: 30 days post-formation.

Penalties for Non-Compliance

Businesses that fail to file or provide false information risk $500 daily fines and potential imprisonment. A 90-day correction window allows updates to errors without penalty.

ZenBusiness: Your BOI Filing Solution

ZenBusiness ensures accurate and timely BOI submissions, helping Campbell businesses meet deadlines and avoid penalties. Their expertise makes the process simple and stress-free. File your BOI report today with ZenBusiness.

Additional BOI Resources

Act now to ensure your business stays compliant!